[PR15] Progress in charge levels

Key message

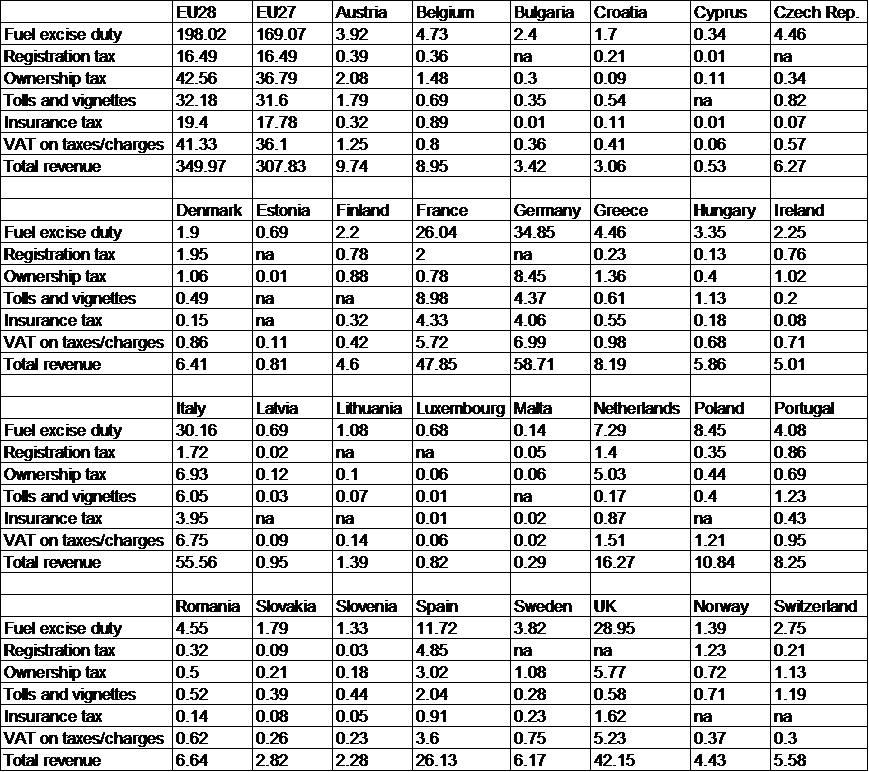

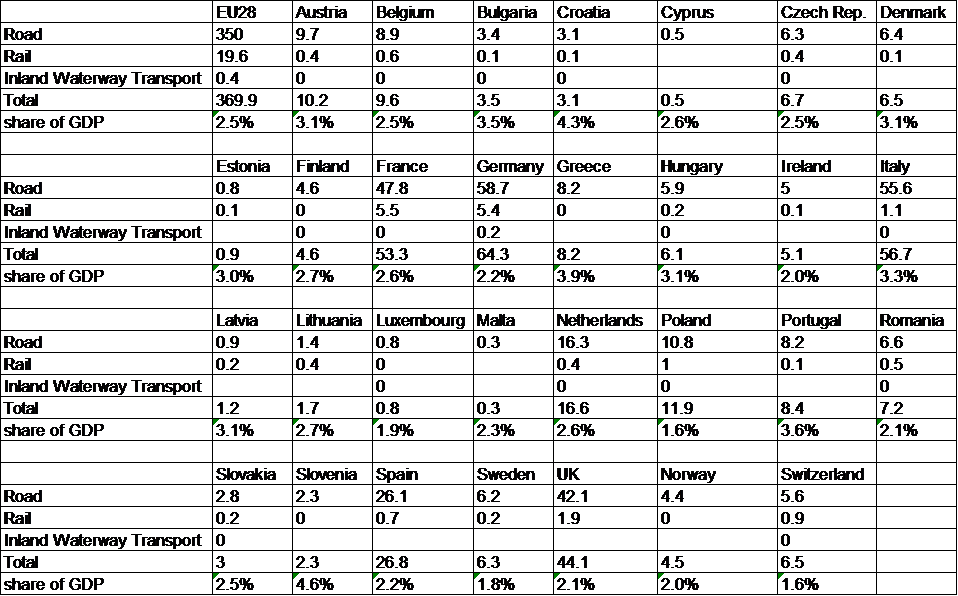

Total revenues from taxes/charges from road, rail and inland water transport in the EU28 amounted to EUR 370 billion in 2016. This is approximately 2.5% of EU28 GDP in 2016. Aviation and maritime revenues are calculated only for a set of selected airports and ports, so it is not possible to determine the share of these revenues in total aviation and maritime tax/charges revenues of transport in the EU28. Passenger cars contribute the main share of revenues, which can be explained both by the large share that this category of vehicles has in the total transport performance, and by the relatively high burden of these vehicles with taxes and charges. Other road transport vehicles also make a significant contribution to the total revenue, especially road freight transport and revenue from railway passenger transport. Revenues from rail freight transport and inland water transport are very small compared to revenues from other modes of transport. In 2016, Slovenia collected the most revenue from taxes/charges among all EU 28 countries, taking into account road, rail and river transport (4.6% of GDP, PPS corrected, EU28 average 2.5%).

Definition

Although taxes and charges are often used interchangeably, they are different concepts. Taxes are compulsory, unrequited payments to the general government that usually go to the general budget or are earmarked for specific purposes. Charges, on the other hand, are compulsory, requited payments to either general government or to (semi-)private bodies (Eurostat, 2001). This indicator deals with a special subset of taxes and charges, i.e. transport taxes and charges directly related to the ownership and use of means of transport, including taxes related to the use of infrastructure (CE Delft, 2019). Inland water traffic is not relevant for Slovenia, so it is not discussed in detail in the indicator.

Charts

CE Delft, 2019. Transport taxes and charges in Europe An overview study of economic internalisation measures applied in Europe. Delft, CE Delft, March 2019

CE Delft, 2019. Transport taxes and charges in Europe An overview study of economic internalisation measures applied in Europe. Delft, CE Delft, March 2019

| Fuel excise duty[%] | Registration tax[%] | Ownership tax[%] | Tolls and vignettes[%] | Insurance tax[%] | VAT on taxes/charges[%] | |

|---|---|---|---|---|---|---|

| EU28 | 0.57 | 0.05 | 0.12 | 0.09 | 0.06 | 0.12 |

| EU27 | 0.55 | 0.05 | 0.12 | 0.10 | 0.06 | 0.12 |

| Austria | 0.40 | 0.04 | 0.21 | 0.18 | 0.03 | 0.13 |

| Belgium | 0.53 | 0.04 | 0.17 | 0.08 | 0.10 | 0.09 |

| Bulgaria | 0.70 | 0 | 0.09 | 0.10 | 0.00 | 0.11 |

| Croatia | 0.56 | 0.07 | 0.03 | 0.18 | 0.04 | 0.13 |

| Cyprus | 0.64 | 0.02 | 0.21 | 0 | 0.02 | 0.11 |

| Czech Republic | 0.71 | 0 | 0.05 | 0.13 | 0.01 | 0.09 |

| Denmark | 0.30 | 0.30 | 0.17 | 0.08 | 0.02 | 0.13 |

| Estonia | 0.85 | 0 | 0.01 | 0 | 0 | 0.14 |

| Finland | 0.48 | 0.17 | 0.19 | 0 | 0.07 | 0.09 |

| France | 0.54 | 0.04 | 0.02 | 0.19 | 0.09 | 0.12 |

| Germany | 0.59 | 0 | 0.14 | 0.07 | 0.07 | 0.12 |

| Greece | 0.54 | 0.03 | 0.17 | 0.07 | 0.07 | 0.12 |

| Hungary | 0.57 | 0.02 | 0.07 | 0.19 | 0.03 | 0.12 |

| Ireland | 0.45 | 0.15 | 0.20 | 0.04 | 0.02 | 0.14 |

| Italy | 0.54 | 0.03 | 0.12 | 0.11 | 0.07 | 0.12 |

| Latvia | 0.73 | 0.02 | 0.13 | 0.03 | 0 | 0.09 |

| Lithuania | 0.78 | 0 | 0.07 | 0.05 | 0 | 0.10 |

| Luxembourg | 0.83 | 0 | 0.07 | 0.01 | 0.01 | 0.07 |

| Malta | 0.48 | 0.17 | 0.21 | 0 | 0.07 | 0.07 |

| Netherlands | 0.45 | 0.09 | 0.31 | 0.01 | 0.05 | 0.09 |

| Poland | 0.78 | 0.03 | 0.04 | 0.04 | 0 | 0.11 |

| Portugal | 0.49 | 0.10 | 0.08 | 0.15 | 0.05 | 0.12 |

| Romania | 0.69 | 0.05 | 0.08 | 0.08 | 0.02 | 0.09 |

| Slovakia | 0.63 | 0.03 | 0.07 | 0.14 | 0.03 | 0.09 |

| Slovenia | 0.58 | 0.01 | 0.08 | 0.19 | 0.02 | 0.10 |

| Spain | 0.45 | 0.19 | 0.12 | 0.08 | 0.03 | 0.14 |

| Sweden | 0.62 | 0 | 0.18 | 0.05 | 0.04 | 0.12 |

| United Kingdom | 0.69 | 0 | 0.14 | 0.01 | 0.04 | 0.12 |

| Norway | 0.31 | 0.28 | 0.16 | 0.16 | 0 | 0.08 |

| Switzerland | 0.49 | 0.04 | 0.20 | 0.21 | 0 | 0.05 |

CE Delft, 2019. Transport taxes and charges in Europe An overview study of economic internalisation measures applied in Europe. Delft, CE Delft, March 2019

| Electricity tax [million €, PPS adjusted] | Fuel excise duty [million €, PPS adjusted] | Rail access charges [million €, PPS adjusted] | Charges on specific parts of the infrastructure [million €, PPS adjusted] | ETS [million €, PPS adjusted] | |

|---|---|---|---|---|---|

| EU28 | 1.22 | 10.81 | 85.99 | 1.59 | 0.38 |

| EU27 | 1.36 | 8.16 | 89.02 | 1.05 | 0.41 |

| Austria | 6.49 | 8.17 | 84.94 | 0 | 0.40 |

| Belgium | 0 | 0 | 99.75 | 0 | 0.25 |

| Bulgaria | 1.17 | 19.10 | 77.42 | 0 | 2.30 |

| Croatia | 0.26 | 53.06 | 46.14 | 0 | 0.55 |

| Czech Republic | 0 | 41.23 | 57.79 | 0 | 0.98 |

| Denmark | 0.27 | 13.14 | 43.38 | 42.58 | 0.63 |

| Estonia | 0.05 | 37.52 | 62.42 | 0 | 0.02 |

| Finland | 0 | 13.40 | 77.66 | 7.68 | 1.25 |

| France | 0.06 | 0.94 | 96.48 | 2.42 | 0.09 |

| Germany | 2.65 | 7.63 | 89.29 | 0 | 0.43 |

| Greece | 0.09 | 48.40 | 51.36 | 0 | 0.16 |

| Hungary | 0.77 | 0 | 98.34 | 0 | 0.88 |

| Ireland | 0 | 8.69 | 91.26 | 0 | 0.04 |

| Italy | 0 | 4.98 | 94.53 | 0 | 0.49 |

| Latvia | 0 | 56.65 | 43.34 | 0 | 0.00 |

| Lithuania | 0 | 24.09 | 75.90 | 0 | 0.00 |

| Luxembourg | 0.22 | 4.24 | 95.11 | 0 | 0.44 |

| Netherlands | 1.35 | 8.31 | 89.73 | 0 | 0.62 |

| Poland | 2.06 | 7.17 | 89.48 | 0 | 1.28 |

| Portugal | 0 | 17.88 | 81.30 | 0 | 0.83 |

| Romania | 0.17 | 24.59 | 74.79 | 0 | 0.45 |

| Slovakia | 0 | 21.80 | 77.72 | 0 | 0.48 |

| Slovenia | 0 | 45.47 | 52.55 | 0 | 2.03 |

| Spain | 5.29 | 16.90 | 77.03 | 0 | 0.78 |

| Sweden | 0 | 0 | 83.49 | 15.80 | 0.71 |

| United Kingdom | 0 | 35.28 | 58.04 | 6.50 | 0.18 |

| Norway | 0 | 0 | 99.02 | 0 | 1.02 |

| Switzerland | 0 | 0.16 | 99.84 | 0 | 0 |

CE Delft, 2019. Transport taxes and charges in Europe An overview study of economic internalisation measures applied in Europe. Delft, CE Delft, March 2019

| Road[billion €, PPS adjusted] | Rail[billion €, PPS adjusted] | Inland Waterway Transport[billion €, PPS adjusted] | Total[billion €, PPS adjusted] | share of GDP[%] | |

|---|---|---|---|---|---|

| EU28 | 350 | 19.60 | 0.40 | 369.90 | 0.03 |

| Austria | 9.70 | 0.40 | 0 | 10.20 | 0.03 |

| Belgium | 8.90 | 0.60 | 0 | 9.60 | 0.03 |

| Bulgaria | 3.40 | 0.10 | 0 | 3.50 | 0.04 |

| Croatia | 3.10 | 0.10 | 0 | 3.10 | 0.04 |

| Cyprus | 0.50 | 0.50 | 0.03 | ||

| Czech Republic | 6.30 | 0.40 | 0 | 6.70 | 0.03 |

| Denmark | 6.40 | 0.10 | 6.50 | 0.03 | |

| Estonia | 0.80 | 0.10 | 0.90 | 0.03 | |

| Finland | 4.60 | 0 | 0 | 4.60 | 0.03 |

| France | 47.80 | 5.50 | 0 | 53.30 | 0.03 |

| Germany | 58.70 | 5.40 | 0.20 | 64.30 | 0.02 |

| Greece | 8.20 | 0 | 8.20 | 0.04 | |

| Hungary | 5.90 | 0.20 | 0 | 6.10 | 0.03 |

| Ireland | 5 | 0.10 | 5.10 | 0.02 | |

| Italy | 55.60 | 1.10 | 0 | 56.70 | 0.03 |

| Latvia | 0.90 | 0.20 | 1.20 | 0.03 | |

| Lithuania | 1.40 | 0.40 | 1.70 | 0.03 | |

| Luxembourg | 0.80 | 0 | 0 | 0.80 | 0.02 |

| Malta | 0.30 | 0.30 | 0.02 | ||

| Netherlands | 16.30 | 0.40 | 0 | 16.60 | 0.03 |

| Poland | 10.80 | 1 | 0 | 11.90 | 0.02 |

| Portugal | 8.20 | 0.10 | 8.40 | 0.04 | |

| Romania | 6.60 | 0.50 | 0 | 7.20 | 0.02 |

| Slovakia | 2.80 | 0.20 | 0 | 3 | 0.03 |

| Slovenia | 2.30 | 0 | 2.30 | 0.05 | |

| Spain | 26.10 | 0.70 | 26.80 | 0.02 | |

| Sweden | 6.20 | 0.20 | 6.30 | 0.02 | |

| United Kingdom | 42.10 | 1.90 | 44.10 | 0.02 | |

| Norway | 4.40 | 0 | 4.50 | 0.02 | |

| Switzerland | 5.60 | 0.90 | 0 | 6.50 | 0.02 |

Methodology

- CE Delft, 2019. Transport taxes and charges in Europe An overview study of economic internalisation measures applied in Europe. Delft, CE Delft, March 2019.

- EEA, 2006.TERM 22 – Progress in charge levels,. European Environmental Agency, 2006. (Kazalnik je bil arhiviran in se več ne spremlja, prav tako ni več aktivne povezave do dokumenta)

- EC, 2011. White Paper: Roadmap to a Single European Transport Area : Towards a competitive and resource efficient transport system, COM(2011)144 final, Brussels: European Commission (EC).

- EC, 2016. Communication from the Commission to the European Parliament, The Council, The European Economic and Social Committee and the Committee of the Regions : A European Strategy for Low-Emission Mobility, COM(2016)501 final, Brussels: European Commission (EC).

- EC, 2017. Proposal for a Council Directive amending Directive 1999/62/EC on the charging of heavy goods vehicles for the use of certain infrastructures, as regards certain provisions on vehicle taxation, COM(2017) 276, Brussels: European Commission (EC).

- Evropski parlament, 2008. Directive 2008/101/EC of the European Parliament and of the Council of 19 November 2008 amending Directive 2003/87/EC so as to include aviation activities in the scheme for greenhouse gas emission allowance trading within the Community. Official Journal of the European Union, L 8(13.1.2009), pp. 3-21.

- Evropski parlament, 2009. Directive 2009/12/EC of the European Parliament and of the Council of 11 March 2009 on airport charges. Official Journal of the European Union, L 70(14.3.2009), pp. 11-16.

- European Parliament, 2011. Directive 2011/76/EU of the European Parliament and of the Council of 27 September 2011 amending Directive 1999/62/EC on the charging of heavy goods vehicles for the use of certain infrastructure. Official Journal of the European Union, L 269(Official Journal of the European Union), pp. 1-16.

- Evropski parlament, 2011. Directive 2011/76/EU of the European Parliament and of the Council of 27 September 2011 amending Directive 1999/62/EC on the charging of heavy goods vehicles for the use of certain infrastructure. Official Journal of the European Union, L 269(Official Journal of the European Union), pp. 1-16.

- Evropski parlament, 2012. Directive 2012/34/EU of the European Parliament and of the Council of 21 November 2012 establishing a single European railway area. Official Journal of the European Union, L 343(14.12.2012), pp. 32-77.

- Evropski parlament, 2017. Regulation 2017/352 of the European Parliament and of the Council of 15 February 2017 establishing a framework for the provision of port services and common rules on the financial transparency of ports. Official Journal of the European Union, L 57(3.3.2017), pp. 1-18.

- Evropski svet, 2003. Council Directive 2003/96/EC of 27 October 2003 restructuring the Community framework for the taxation of energy products and electricity. Official Journal of the European Union, L 283(31.10.2003), pp. 51-70.